Clearing Markets and Client Clearing Services

Published: February 19, 2026

Abstract

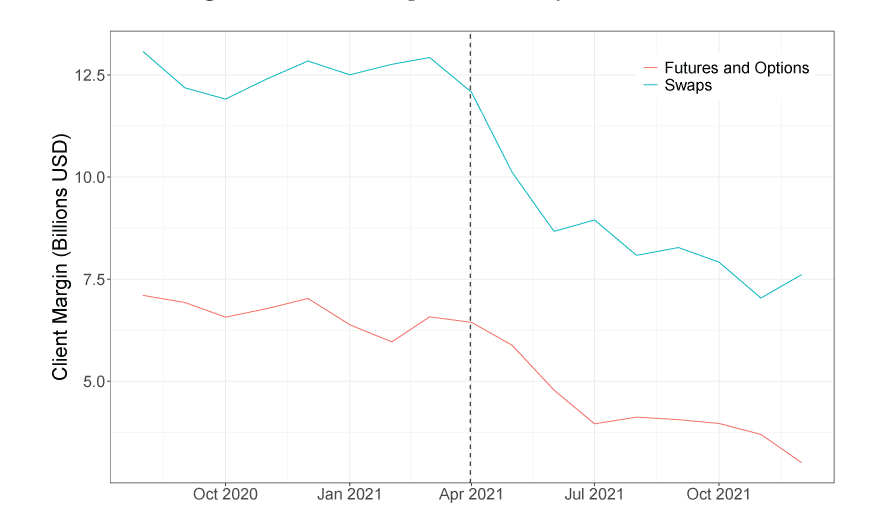

This paper examines client clearing, which now accounts for the majority of risk managed in centrally cleared markets. Using confidential transaction-level data on credit default swaps, we show that client clearing enhances netting efficiency for dealers and generates pricing advantages for clients. Adoption of central clearing leads clients to expand their sets of dealer trading partners, thereby enhancing market access and competition. To access central counterparties, clients depend on clearing member firms, favoring those with stronger credit quality and with whom they have established trading relationships. Offering these services creates spillover benefits for member firms’ market making activity by improving client retention and pricing power. Clients’ reliance on clearing members creates operational fragilities under stress, especially for those with limited member relationships. Our findings provide novel insights about the economic consequences of client clearing and are particularly relevant given recent clearing mandates, most notably in U.S. Treasury markets.

Keywords: Central Clearing, Client Relationships, Counterparty Risk, Market Structure, Clearing Agents

JEL Classifcation Numbers: G23,G28,L14